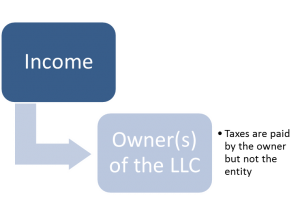

An LLC can be a pass-through entity for federal income tax purposes. A pass-through entity means that taxes are only paid once at the member level. There is no federal taxation at the LLC level; thus the “pass-through” tax effect.

The members report the profits and losses on their individual tax returns. When there is more than one member this also requires the filing of a partnership tax return.

Here is an illustration of the pass-through taxation:

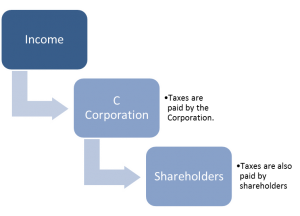

An Ohio corporation is not a pass-through entity. By default, when you incorporate the company is designated as a C-corporation (Sub-chapter C of the Internal Revenue Code). This means that a corporation is taxed twice; once at the corporate level and once at the shareholder level. The corporation will need to file a tax return to reflect the profits and losses and the shareholders will need to file a tax return to reflect the distributions (also referred to as dividends) made to them.

Here is an illustration of the C-corporation’s tax process:

There is also an option for a corporation (typically referred to as an S-corp) to only have one level of taxation. An S-corporation has pass-through taxation but with a strict standard of distributions to the shareholders.

Before selecting an entity it is best to review the benefits and drawbacks to all three types of entity, LLC, C-corporation, and S-Corporation, before making a decision.

Share this Post